COVID-19: Legislation, Loans + Grants

Comprehensive information about the CARES Act – including the PPPL and EIDL – as well as federal + local relief options for small businesses.

—

Legislation

Updated (3/27) @ 2:45pm ET

The House passed the $2 trillion stimulus package by voice vote, sending it to President Trump for his signature. As of (4/16), the federal government announced that all funds have been allocated to small businesses. There is an urge to allocate additional fund but this has not yet passed. Stay tuned for additional updates.

Information about the CARES Act

EIDL + PPP Loan Comparison [Here]

Empowered Hospitality

CARES Act one-pager [Here] + Family First Coronavirus Response Act (FFCRA) one-pager [Here]James Beard Foundation + Arnold & Porter [Here]

Understanding the PPP, EIDL + Other Relief Available to Restaurant OwnersJames Beard Foundation [Here]

PPP Fact Sheet

—

Articles about The CARES Act

(4/6) Eater [Here]

”New Additions to the Federal Stimulus Bill Could Screw Restaurants As Banks Profit”(3/27) Independent Restaurant’s Coalition [Here]

“Chefs & Restaurateurs: What To Do Now That the Stimulus is the Law”(3/27) Eater [Here]

“Everything to Know About How the $2 Trillion Stimulus Helps (and Fails) Restaurants“(3/25) GrubStreet [Here]

“Congress’s $2 Trillion Relief Package Offers Hope to Restaurateurs”(3/27) New York Times [Here]

“F.A.Q. on Stimulus Checks, Unemployment and the Coronavirus Bill“

Business Loans and Grants

Key Economic Relief Options for Restaurant Operators

For restaurant operators, there are (3) key relief opportunities — SBA’s EIDL, CARES Act’s PPPL + CARES Act’s Employee Retention Tax Credit. Please find a breakdown of all three below. Please note, although you are able to apply for multiple loans, the potential grant of the EIDL and the forgivable portion of the PPPL are contingent on one another and cannot both be applied in full to your company. Please see the EIDL + PPPL comparison spreadsheet [Here]

[USA] SBA | Economic Injury Disaster Relief Loan (EIDL) [Apply Here]

The EIDL loan is offered through the SBA and covers the financial obligations and operating expenses that could have been met had the disaster not occurred. The EIDL is not forgivable but, in addition to this loan the SBA is offering an immediate $10,000 advance (the Emergency Economic Injury Grant) within three days of applying for an EIDL. To access the advance, you must first apply for an EIDL and then request the advance. The advance is a grant and does not need to be repaid.

3.75% Interest (businesses) | 2.75% Interest (non-profits) | 30-Year Term

—

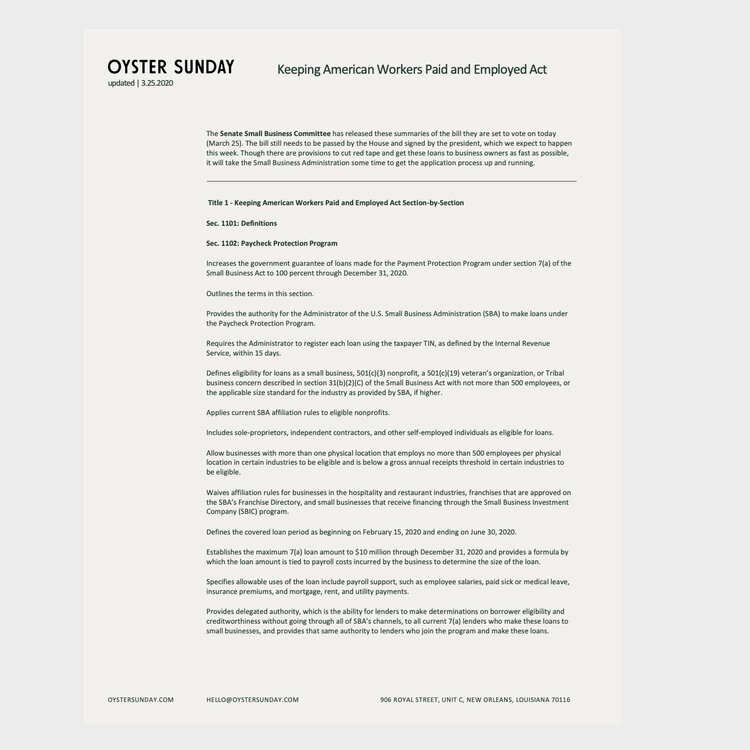

[USA] CARES Act’s Payroll Protection Program (PPPL)

The PPPL is intended to keep team on payroll and is applied through your bank (vs. EIDL which is applied online). The max loan is equal to 2.5x the average monthly payroll costs of the 12 months prior to your application (or, if a new business, the payroll from 2020). The loan can be forgiven if the loan is used by the borrower during an 8-week period (the “Covered Period”) after the origination date of the loan — 75% of the loan must be used towards payroll cost. The amount forgiven is reduced based on failure to maintain the average number of full-time equivalent employees versus the period from either February 15, 2019, through June 30, 2019, or January 1, 2020, through February 29, 2020, as selected by the borrower.

IMPORTANT NOTE: For those who had to make the hard choice regarding layoffs, your ability (or inability) to rehire needs to be taken into account since this will affect your ability to use the loan in full in the granted “covered period”.

1% Interest | 2-Year Term

—

[USA] CARES Act’s Employee Retention Tax Credit

In lieu of the PPPL (which many restaurants are finding confining due to the forgiveness period), the employee retention tax credit is a broad based refundable tax credit designed to encourage employers to keep employees on their payroll. The credit is 50% of up to $10,000 in wages paid by an employer whose business is fully or partially suspended because of COVID-19 or whose gross receipts decline by more than 50%. | IRS Resource [Here] + US Treasury Resource [Here]

—

Additional Loan + Grant Opportunities

[Overview] COVID-19 Loan + Relief Resources for Small Businesses [Here]

This includes a list of state in all 50 states around the US relief. Please see this great comprehensive spreadsheet for a comprehensive list c/o Gusto.

[USA] SBA | Loan Programs [Apply Here]

Small businesses can apply for SBA-approved loans for working capital to support their business. Additional information can be found [Here]

[USA] ConvertKit Relief Fund [Apply Here]

$154K committed to offer relief cash up to $500 for creators.

[USA] Secretary of Health and Human Services | Healthcare Waivers

The Secretary of Health and Human Services will be able to immediately waive provisions of applicable laws and regulations to give doctors, all hospitals, and healthcare providers maximum flexibility to respond to the virus and care for patients. (3/13)

[USA] Department of Education | Federal Student Loan Relief

COVID-related guidance: If you’re having trouble making payments, contact your loan servicer as soon as possible. If you have a Federal Perkins Loan, contact your school. You can easily avoid the consequences of delinquency or default by staying in touch with your servicer or school. Your servicer or school can provide information about deferment or forbearance options that allow you to temporarily stop making payments on your loans. You may also be able to change to a different repayment plan that would give you a lower monthly payment.

[USA] RWCF | Covid-19 Emergency Relief Fund [Here]

the RCWF Board of Directors has approved directing funds raised during this crisis to be allocated in the following ways:

50% for direct relief to individual restaurant workers

25% for Non-Profit Organizations serving Restaurant Workers in Crisis

25% for zero-interest loans for restaurants to get back up and running.

[USA] USBG Foundation | Grants [Here]

Bartender emergency assistance program available to all bartenders or the spouse or child of a bartender.

[USA] James Beard Foundation | Relief Fund [Here]

[USA] One Fair Wage| Emergency Fund [Here]

providing cash assistance to restaurant workers, car service drivers, delivery workers, personal service workers and more who need the assistance due to COVID-19.

[USA] ROC | Emergency Relief Fun [Here]

Restaurant Opportunities Centers United is providing resources and financial assistance to restaurant workers impacted by the coronavirus crisis.

[New York] NYC Loans + Grants [Here]

[Louisiana] New Orleans Loans + Grants [Here]

[Louisiana] Louisiana Service Industry Support Programs [Here]

On Going | In the city of New Orleans, a group has been working on finding solutions via policy that can roll up to a city, state and federal level. Please read this document for daily updates and information as it rolls out in real time.

Disclaimer: The consolidated resources are here for your consideration. The information provide above is not legal advice. We recommend talking to your lawyer to ensure all state + federal compliance is maintained. If you do not have legal representation, we would be happy to connect you with legal counsel. We understand that circumstances are changing quickly and we are updating content as it is available.

![[COVID-19] Chamber-of-Commerce-Loan-Checklist_Page_1.jpg](https://images.squarespace-cdn.com/content/v1/5e989aa79f158d5d2772fb66/1587242332344-FF3ZHS24EOSLTTYGYF5G/%5BCOVID-19%5D+Chamber-of-Commerce-Loan-Checklist_Page_1.jpg)

![[COVID-19] Chamber-of-Commerce-Loan-Checklist_Page_2.jpg](https://images.squarespace-cdn.com/content/v1/5e989aa79f158d5d2772fb66/1587242323444-1XFHBCW7IWARIF2FA9UO/%5BCOVID-19%5D+Chamber-of-Commerce-Loan-Checklist_Page_2.jpg)

![[COVID-19] Chamber-of-Commerce-Loan-Checklist_Page_3.jpg](https://images.squarespace-cdn.com/content/v1/5e989aa79f158d5d2772fb66/1587242324254-5KBWCVV3J7XANWNPNZUO/%5BCOVID-19%5D+Chamber-of-Commerce-Loan-Checklist_Page_3.jpg)

![[COVID-19] Chamber-of-Commerce-Loan-Checklist_Page_4.jpg](https://images.squarespace-cdn.com/content/v1/5e989aa79f158d5d2772fb66/1587242332338-FPP9E2A0K67X7TRSE224/%5BCOVID-19%5D+Chamber-of-Commerce-Loan-Checklist_Page_4.jpg)